In this Private Equity Insight we will cover:

- How ERP technology can improve operation for PE firms and their Portfolio Companies.

- What solutions make up an optimal ERP ecosystem for PE firms and Portcos.

- The financial savings an effective ERP technology ecosystem can deliver.

- Steps to implementing an ERP ecosystem that drives maximum value.

Introduction

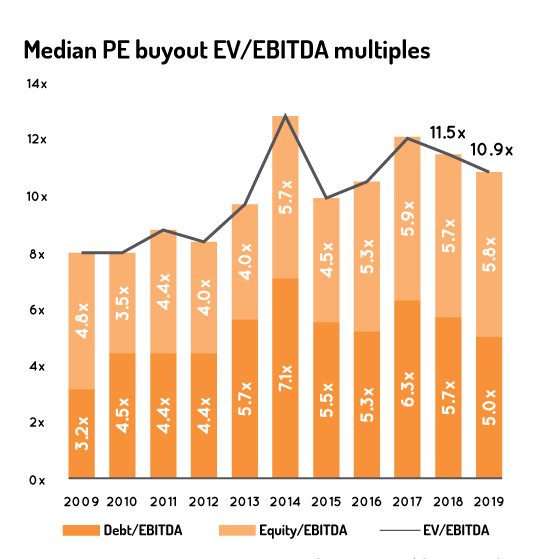

Today’s Private Equity (PE) market is highly competitive; with more firms with more cash chasing fewer targets, purchase prices are going up while expectations for exit values remain high. At the same time, PE firms need to compete for uniqueness in crowded markets.

To meet those expectations, PE and Venture Capital (VC) firms need new ways to build Portco value. The savviest PE firms now focus on operational improvement initiatives like digital transformations. Their strategies often include implementing ERP technology ecosystems in their Portcos. PE firms that select the right ERP technology and follow a robust implementation process create more potential value.

What exactly is an ERP ecosystem, how can it be effectively implemented, and how can the right private equity technology stack build operational value?

Read on, as we will apply our decade-plus of ERP implementation experience to explain.

Source: PitchBook / Geography: US

“The era when private equity was associated with mere financial engineering is a distant memory. after several cycles and events ranging from extraordinarily cheap capital to the credit crunch, most people in the industry argue that private equity creates value through underlying business and operational improvements.”¹

Trajectory Group has spent more than 15 years helping clients implement ERP technology ecosystems efficiently to maximize operational improvement. Using our in-house ERP implementation methodology, we’ve guided more than 25 North American PE and VC firms and their 100+ portfolio companies through the adoption of ERP and related solutions including Salesforce, Boomi, FloQast, Expensify, OpenAir, Bill.com, and more.

Along the way, we’ve seen the value that efficient ERP implementation can deliver for PE firms and their Portcos. In this paper, co-authors Alex Olano of Trajectory Group, Casey Conner of ST6 and Marc Craver of FloQast will focus on how ERP technology can drive value generation, what an optimal ecosystem looks like and how to ensure a smooth transition to a new ERP.

If it seems like you’re hearing more lately about the operational improvement mindset in the PE industry, it’s because that’s where firms are now finding value.

“Historically, many PE firms have looked at their investments as a pure numbers game and had little interest in hands-on operational changes. That view is rapidly changing as other firms see the success of companies that are driving real operational improvements and therefore driving up EBITDA% and ultimately portfolio company sale value.”

Marc Craver

Director, Business Development, FloQast

One way to achieve operational improvement is to update and streamline technology. Some PE firms create their own operations teams to lead improvement in their portfolio companies. Most firms, however, work with a specialist operating team of experienced industry professionals and consultants who bring their own technology ecosystem playbook, that they’ve chosen for compatibility, efficiency, and long-term value.

Private Equity Technology Stacks, Operational Improvement & Value Creation

However, not every portfolio company will see the same kind of return on investment from ERP ecosystem implementation. Certain conditions offer the best return, and we’ll discuss those below. The timing of the investment matters, as well, to deliver optimal ROI on exit. Value-creation goals need to be clearly defined from the start. And the data and processes that the new tech stack supports should be worth the investment.

Let’s look more closely at each of these elements.

“Web-based technologies enable you to dramatically improve how you run your business. You’re a good candidate if you’re looking to increase market share, aggressively pursue cost reduction or greater efficiency, or prevent customer-service problems.”2

Which Companies Make the Best Candidates for Technology Investments?

How likely to pay off is an investment in ERP and other tech implementation? Many PE and VC executives say that the companies that benefit most from technology improvements3 have the following characteristics:

- Are middle-market organizations

- Offer new products regularly and/or are expanding operations internationally

- Need to upgrade their technology infrastructure in order to scale

- Need to migrate to a SaaS technology model

- Need systems that allow easy inclusion of add-on acquisitions or exclusion of carve-outs

- Stability and support working remotely

- Increasing M&A activity

All of these characteristics describe organizations that typically carry high levels of technology debt-also known as technical debt.

“Many targets are operating with legacy systems that don’t adequately drive efficiency and the ability to adequately manage the business in real-time.”4

What Is Technology Debt?

IT and consulting experts have been debating the exact definition of technical debt for years. For the purpose of evaluating the potential ROI on technology upgrades, Accenture’s Technical Debt Model5 is helpful. It describes four component costs of aging applications and IT infrastructure:

- Principal: the cost to maintain and remediate legacy technology

- Interest: the cost of workarounds required to cope with old technology, like process delays and staffing issues

- Liability: the cost of outages, data breaches, and other acute problems caused by an aging infrastructure and failed workarounds that require immediate, often costly fixes

- Opportunity costs: growth and expansion opportunities that are missed because companies are spending heavily on reactive tech maintenance and workarounds

For example, a company that last upgraded their tech stack a decade ago then cut their IT budget and now has everyone take extra-long “coffee breaks” twice a day because the database takes so long to update is paying a lot of interest on their tech debt.

When hackers find their way into that poorly patched database and resell the company’s customer data on the dark web, the company will face expensive liability costs like customer churn, remediation expenses, and possible GDPR fines. Those added expenses– and the related chaos– will slow down the company from developing new products and expanding into new markets.

Our example company is a clear, if extreme, candidate for an ERP technology ecosystem overhaul, and outside investment may be the only way it will happen. When portfolio companies –and PE firms themselves– have technology debt that’s interfering with operations, cost management, and growth, the time may be right for a new ERP implementation.

However, not every target with lots of technology debt is a good investment. According to Alex Olano at Trajectory Group, the technology upgrades are only valuable if the processes they support and the data they have to work with are solid. When those foundational elements and the ERP system combine to produce efficient business processes, clean and accurate data, and quick access to reliable information for potentials buyers, then the real value is realized.

When to Invest in ERP Implementation? Earlier Is Better

We advocate for implementing ERP and other tech stack upgrades early in the holding period, within the first year or two.

In our experience, portfolio company leadership can find it difficult to sign off on ERP ecosystem improvements, because the cost of implementation delivers a hit to short-term earnings. This is understandable, given the cost of ERP software and the time required to install and customize the ERP, integrate it with other software in the ecosystem, and train employees on its use.

However, once the new ecosystem is fully implemented, the reduction in technical debt interest and liability –in other words, the increases in operational efficiency, scalability, compliance and security–add value well before the average five-year holding period ends.

“Led by the right skill set, especially at the C-suite level, technological innovation has the potential to transform portfolio companies throughout the investment life cycle.”6

ERP Ecosystem Value Value Creation and PE Goals

So far we have talked about the value an ERP technology ecosystem can add in general terms. Now it’s time to take a closer look at the specific ways ERP implementation can add value and how well those value-adds align with PE value creation priorities.

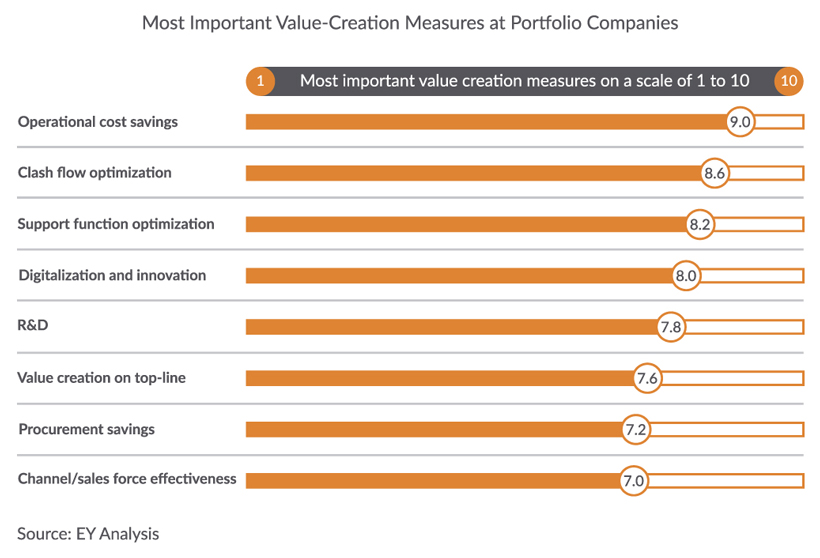

EY analytics’ 2018 market research and interviews7 with EU-based PE executives ranked their top eight Portco value-creation steps:

Reference: Creating value throughout the private equity investment lifecycle in the digital era.

Ernst & Young, Creating value throughout the private equity investment lifecycle in the digital era, p. 12.

“The right ERP solution can support many if not all of these steps. In our experience, operational cost savings, support function optimization, procurement savings, and, of course, digitalization and innovation are the areas where the ERP ecosystem can create the most value.”

Alex Olano

President, Trajectory Group

An ERP technology ecosystem that’s properly customized and used by employees who are fully trained can move the other value-creation steps forward too.

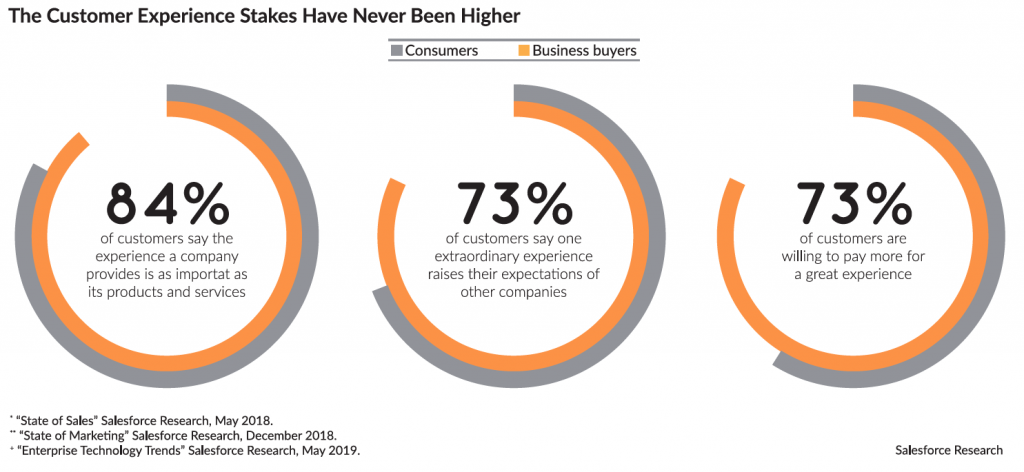

For example, when sales and marketing teams have efficient access to unified, real-time data, they can connect more effectively with customers, who increasingly expect a high-quality seamless, personalized experience, whether they are making B2C or B2B purchasing decisions.8

The ERP’s capacity to help companies deliver a better customer experience can improve marketing and sales effectiveness which leads to top-line value creation as well.

Because technology improvements support so many value-creation priorities and make scalability easier, they translate into higher exit values. Marc Craver at FloQast says there are two ways that ERP implementations can increase perceived value among buyers:

1. During due diligence. When a target company can respond to prospective buyers’ requests for data quickly and with detailed data, that indicates operational excellence. Although this won’t create higher value for the company, buyers won’t discount purchases or plan to spend more money on systems.

2. When comparing operational costs as a percentage of EBITDA benchmarks. When the target’s accounting or sales operations teams are not bloated, that indicates operational efficiency supported by a good ERP system.

“Upgrading a portfolio company’s digital capabilities may not lead to exiting the investment more quickly, as it may take time to transform the acquisition and get it running up to speed. But it should help you develop the portfolio company to its fullest potential so that it either performs better and increases returns, or fetches a higher premium or multiple when it is eventually sold.”9

“There’s often a disconnect between the use of technology in the PE industry and in their portfolio companies. Think about it for a minute. When was the last time that partners at your PE firm discussed the tech stack of your organization?10

Private Equity Firms Benefit From Tech Stack Improvements, Too

Some private equity firms are carrying their own burdensome technology debt. However, as they see the potential upsides of ERP implementation for their portfolio companies, they are increasingly looking to make upgrades to generate value in-house.

The right ERP can make PE firms more operationally efficient. For example:

- Streamlined data handling can give managers a single view of clients, vendors, and Portco data.

- A single source of data can also enable more complete and nuanced financial forecasts.

- Automation can reduce the number of work hours required to create specialized reports for compliances and taxes, freeing up employees to work on higher-value projects.

There is another benefit. A PE firm that is using the same kind of tech stack as its portfolio companies is more in tune with what those companies need, what they can accomplish and where both Portcos and PE firms can create value.

ERP, Portcos & Ecosystems: Putting It All Together

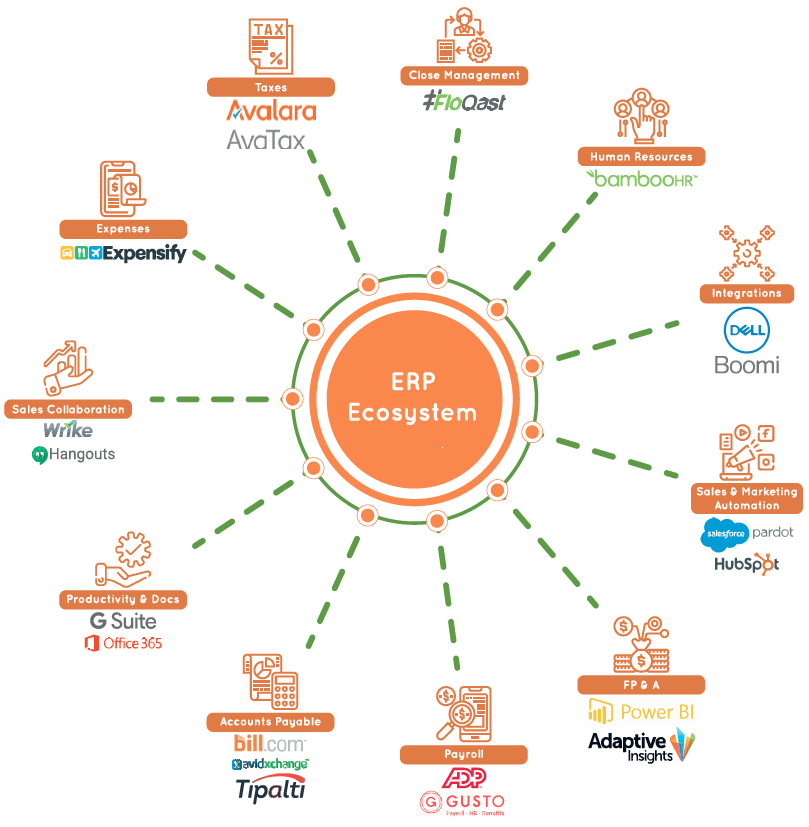

Now that we have examined the value ERP ecosystems can deliver, let’s look at how they are created. We will start with the ecosystem structure. There’s more than one definition of technology ecosystems. We like this explanation from Brett Jones of Nielsen Connect Partner Network:

“Ecosystems are about dynamic interactions between people, software, data, systems, and services. But what makes them unique in the world of technology is the streamlined flow to connect, share, grow and transform together.”11

Within the wider technology ecosystem, the ERP technology ecosystem is the combination of technology applications that enable efficient and scalable functioning of core business processes including HR, Finance Planning, and Analysis.

The ERP Technology Ecosystem & Playbook

It’s a good practice for PE firms to segment their Portcos by vertical and technology maturity tiers. This allows for an understanding of the type of technology stack to build out. The complexity of the ERP ecosystem and the need to tailor it for each portfolio company are why private equity operations teams build ERP playbooks. With a list of the top tools, knowledge of how they work together, and the skills required to install and configure them, operations teams save time and money getting Portco technology improvements up and running. Here is an example of a stack for a typical middle-market company:

Here is a case in point. When working with portfolio companies, Trajectory Group’s expertise centers on the implementation of ERP technology applications that work best together to save our clients time and money. Our tech playbook typically includes:

- Oracle NetSuite: to control the complete back-office & financials

- FloQast: to help reduce the month-end close time & boost accounting collaboration

- Expensify or Concur: to easily manage & approve expenses

- AvidXchange: for a hassle-free A/P bolt-on

- Avalara: for easy tax processing across multiple jurisdictions

- Salesforce: prospecting & contact management

- OpenAir PSA: project work management for professionals services

Tips for Optimal ERP Technology Ecosystem Implementation

ERP tech stack implementation is only valuable when it goes smoothly. These suggestions are based on our 15 years of experience helping clients with ERP implementations and our partners’ experience optimizing tech ecosystems. We are also sharing some recommendations from Kearney’s interview with portfolio company CEOs on How PE Operations Teams Create Value, a quick read we highly recommend.12

“The ideal timing of ERP technology element selection and implementation can be broken into six steps, from pre-diligence through to the five-year mark. This allows you to have unique KPIs, to measure operational improvements, measuring the progress of the company through each phase.”

Casey Conner

Operations Investment Executive, ST6partners.com

#1 Timing is everything

- Due Diligence Phase: Business requirements identification and technology solutions selection. It is important to have an implementation game plan outlined before the acquisition takes place.

- Day Zero: Portfolio company acquisition.

- 1 to 90 days: Technology vendors start implementing systems.

- 3 to 18 months: Complete technology solutions.

- 19 months to 3 years: Refine technology solutions.

- 3 to 5 years: Focus on exit, technology changes should be at a minimum.

#2 Engage the operations team early

Overall, 90% of portfolio company CEOs think operations teams should get involved during due diligence. For underperforming firms, 66% to 90% of portfolio company CEOs reported that operations teams did not get involved until well after the acquisition.12

As outlined in the ideal timeline above, the due diligence phase is when the critical activities of business requirements identification and technology solutions selection should take place. Delaying these activities delays the time to implementation and subsequent value creation.

#3 Set realistic priorities for SME involvement

While portfolio company CEOs want operations teams to help identify and prioritize initiatives on which to focus, they warn that operations teams should keep in mind portfolio company resources and time constraints. As part of the evaluation stage, PE firms should assess whether it’s realistic for a portfolio company to achieve the implementation of an ERP technology ecosystem.

#4 Establish rules of engagement early

Portfolio company team members need to understand what is expected of them and what the communication procedures and consequences will be if their responsibilities and accountabilities upfront¹.

Sixty percent of all portfolio company CEOs told Kearney that this was not the case. For underperforming firms, 80% of CEOs said there weren’t good operations teams accountability discussions upfront.

#5 Work from exit strategy backward

One of the PE firms’ strengths is analyzing the longer-term strategic time horizon and determining the best immediate strategic initiatives to maximize exit results. This analysis should be a key driver in determining whether or not implementing an ERP technology ecosystem is the correct move.

#6 Effective KPI design and tracking

PE operations teams should clearly identify the KPIs that they are tracking for a portfolio company. Teams should also determine if accurate KPI information is readily available via the current technology infrastructure or if a different technology infrastructure is required.

A TAD ABOUT TRAJECTORY GROUP

Trajectory Group is a Private Equity Due Diligence Partner, We specialize in ERP implementations, optimizations, integrations & rescues. Our 100% focus on ERP allows for tailored & hassle-free service delivery and the ability to engage on either side of the transaction. Operational improvement is best achieved working with a reliable technology partner. We pair up with top PE teams to help add ERP muscle to their value creation practices.

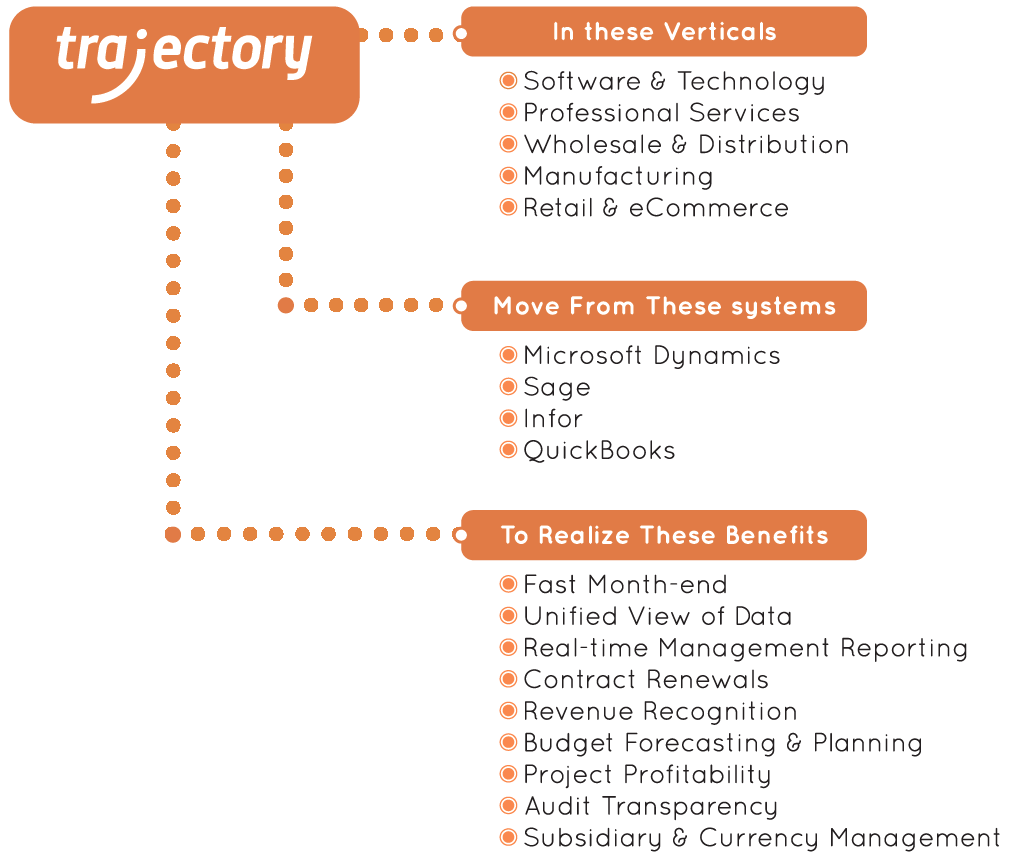

Trajectory Group helps middle-market portfolio companies

The Authors

Alex Olano

President & Operational Partner Trajectory Group

Alex has been running an ERP Due Diligence practice to support operating teams for more than 15 years with 60+ staff members in Toronto, Dallas, Bogota, and Santiago.

Casey Conner

Operations Improvement Executive, ST6partners.com

Casey has extensive experience increasing operational efficiencies, reducing costs, and increasing revenue for PE-backed companies while keeping a sharp focus on delivery metrics and managing vendor, customer, and partner relationships.

Marc Craver

Director, Business Development, FloQast

Marc is an expert business relationship builder with a value-first mindset. He helps private equity teams realize the benefits of having the right technology stack, especially when it comes to financial systems.

Citations

- Haas, R., & Fumo, A. (n.d.). How private equity operations teams create value. Retrieved March 10, 2020, from https://www.kearney.com/private-equity/article/?/a/how-pe-operations-teams-create-value

- Business Development Bank of Canada. (n.d.) Working smarter: 3 strategies for improving business productivity. Retrieved March 11, 2020, from https://www.bdc.ca/en/articles-tools/business-strategy-planning/manage-business/pages/3-strategies-improving-business-productivity.aspx

- Oracle NetSuite & SourceMedia. (2018). The role of technology in the evolution of the private equity industry. Retrieved from https://www.netsuite.com/portal/assets/pdf/netsuite-2018-roundtable.pdf

- Sturisky, G. (2018, June 7). How PE firms can magnify operations transformation portfolio-wide. Retrieved from: https://www.ey.com/en_gl/growth/how-pe-firms-can-magnify-operations-transformation-portfolio-wid

- McClure, D. (2018, September 13). Technical Debt Explained. Retrieved from: https://www.accenture.com/us-en/insights/us-federal-government/technical-debt-explained

- Ernst & Young GmbH. (2018). Creating value throughout the private equity investment life cycle in the digital era. Retrieved from: https://pdfslide.net/documents/creating-value-throughout-the-private-equity-value-throughout-the-private-equity.html

- Ibid.

- Salesforce. (n.d.) State of the Connected Customer. Retrieved March 1, 2020, from https://www.salesforce.com/form/conf/state-of-the-connected-customer-3rd-edition/

- Geminder, G., & Kollin, J. (2018). The Digital Transformation Imperative. Retrieved from: https://assets.kpmg/content/dam/kpmg/us/pdf/2018/05/737580-nss-pe-digital-transformation-whitepaper-v18.pdf

- Dumas, L. (2018, May 17). The Next Edge in Private Equity: Data-Driven Investors. Retrieved from: https://blog.hockeystick.co/the-next-edge-in-private-equity-data-driven-investors

- Jones, B. (2019, May 10). Technology Ecosystems Explained. Retrieved from: https://www.nielsen.com/us/en/insights/article/2019/technology-ecosystems-explained/

- Read @Kearney: How private equity operations teams create value. (n.d.). Retrieved March 1, 2020, from: https://www.kearney.com/private-equity/article/?/a/how-pe-operations-teams-create-value