- Time to read: 15 mins (Grab a latte)

- Skill level: A Curious Business Mind

- Segment: Mid Market

“An ERP can create returns of 10% to 20% on the equity investment for a PE Firm.”

When it comes to creating operational value for a portfolio company (Portco), few technology improvements can be as efficient and effective as a cloud ERP system.

As Private Equity groups compete to stay relevant (in a very crowded market) in their niche, there is a need to continually innovate the secret – sauce of tools & strategies which improve the value chain to boost Portco performance.

In working with Operating Groups on NetSuite ERP projects (pre-transaction until exit), we’ve summarized the absolute essentials that the Operations Group needs to keep in mind when engaging with ERP as part of the value chain.

What we will cover:

- If a target company has an existing ERP, is it a critical consideration at the beginning of a deal?

- When to involve an ERP Diligence Partner/Integrator to optimize value add?

- How to actively avoid the common problems of typical ERP implementations.

- The checklist of Portco operational improvement areas affected by an ERP project.

- The checklist on how to spot ERP opportunities within a deal.

The need to review ERP appears twice in a typical PE transaction, first during the pre-investment operational due diligence phase and second during the post-investment operational improvement phase, when an ERP can create returns of 10 to 20% on the equity investment for a PE firm.

We noticed PE Operating Partners are moving their involvement to earlier in the deal cycle. They were typically called in post-transaction, but now, we are seeing more and more early involvement in pre-transaction to abet the diligence efforts; similarly, the consideration for technology-related value creation has also moved to earlier in the deal cycle. No longer an afterthought, but a critical part of the deal process.

PE Deal Flow / Pre Investment

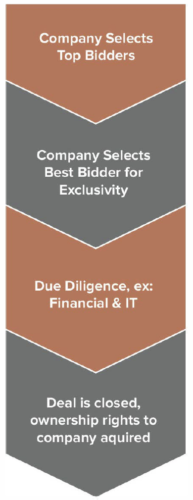

DEAL SOURCING STEPS

DEAL SOURCING STEPS

Let’s take a look at a typical PE deal and spot when ERP comes into the mix. The discovery of a target company (company to invest in) and initial assessment for acquiring at the beginning of the process are more commonly known as ‘deal sourcing’ (the steps on the left). Deal sourcing is commonly done via a financial intermediary.

Technology diligence is not the primary focus of deal sourcing as a PE firm looks into the general picture of the target company.

DUE DILIGENCE STEPS

DUE DILIGENCE STEPS

WHERE ERP MUST BE CONSIDERED

So far we know that during deal sourcing ERP isn’t top of mind, let’s continue on to the Diligence steps. During this phase, financial models are built and company-specific information is gathered to truly understand what works and what doesn’t within the back-end operations of the target company (the potential Portco).

Once the PE group signs the NDA and puts a ‘solid’ first-round bid, it is given access to confidential information in what is referred to as ‘virtual data rooms’. Key detailed company operational data (number of subsidiaries, inventory, vendors, labour cost etc.) is made available to the PE group at this stage.

Many times, that operational data is coming from an ERP system (or multiple fragmented data sources, which hinders sound decision making).

“An investment is founded on business returns that outweigh implementation costs. Simply put, ERP does not print money-it tells you where to find it.”

PE Deal Flow / Pre Investment Cont’d

In a situation with two companies being similar, it’s a no-brainer to invest in a company with an ERP system (one that works) as the PE team can gather clear and concise performance metrics from across various business areas such as manufacturing output, revenue, sales, inventory etc. However, the target company not having an ERP, in itself, also presents an attractive operational improvement opportunity.

For example, assume a company heavily relies on inventory management – a fragmented Information Technology (IT) environment or the use of excel sheets can give you a count of inventory but not include data from the sales team on which inventory is pending sales. So to accurately assess the inventory, someone has to consolidate reports from two or more systems or be content with a half-baked picture of the company. To add, this will cause hours worth of manual work to even understand if the company is worth investing in.

Erp should be a critical consideration within its due diligence, as it directly controls backend operations of a Portco & provides executive insight.

PE Deal Flow / Operational Improvement

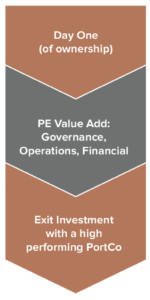

MANAGING THE PORTCO & BEYOND

MANAGING THE PORTCO & BEYOND

(WHERE ERP IS IMPLEMENTED)

Once the deal is closed, the key phases are managing the portfolio company, creating value, and exiting the investment. A big part of value creation for PE firms is in the operational improvement phase when the ‘Operational team’ for the PE firm provides expertise that the portfolio company may otherwise not have (many times top management roles are shuffled in this phase).

Operational improvement will increase the rate of EBITDA growth and margins will also likely lead to the business value being set on a higher earnings multiple in a sale or IPO.

At this stage, a seasoned PE team will evaluate the IT & Financial structure of the company – planning to create operational value with an ERP such as NetSuite.

- Financials: is month-end accounting taking over 7 days? Are financial reports easily accessed with trustworthy data without manual workarounds? Can the team easily tell the most profitable products & lines of business?

- Business Process Optimization: are departments in silos, not really moving as one, is everyone moving toward the same organizational objectives?

- Inventory Control: is there an opportunity to consolidate fragmented inventory tools to one solution to control inventory operations?

- Sales & Customer Organization: is customer information readily available to aid sales & marketing in relevant selling & support? How are opportunities tracked and ranked, does the business have a clear insight into the accurate sales forecast?

- Reporting Intelligence: do executives have access to real-time, relevant reports to be enabled to make smart growth decisions?

PE-Backed Case Example:

The Riverside Company invested in Blue Microphones in 2013. As part of the sale, Blue saw an opportunity to modernize the IT environment to handle (in one system) multiple currencies, inventory, orders, reporting, and even incorporate customer feedback to products in one system.

Implementing NetSuite ERP helped Blue save $80k annually on overhead, increase order accuracy and fulfillment, and provide real-time access to its 3PL partners to fulfill orders from various countries.

Prior to the exit announced in 2018 (to sell a stake to Logitech), Riverside helped Blue enhance sourcing, production, improve brand awareness, grow distribution, grow annual sales over 20% and increase earnings about four times.

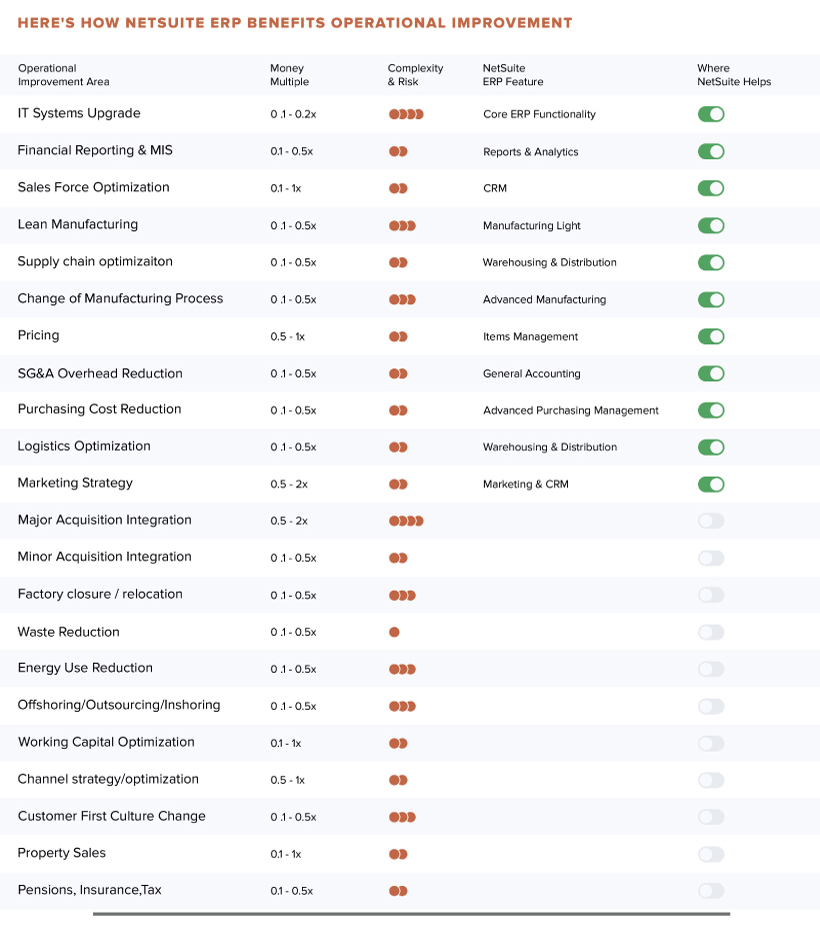

Top Operational Improvement Initiatives

How to Avoid Common ERP Mistakes

You’ll often find that PE ERP projects are aggressive in time, scope, and budget, so as “Day One” looms you’ll need to consider the below factors to prevent common mistakes PE firms tend to make when implementing ERP for the portfolio company.

- Select the Right Partner

Without a reliable ERP partner/integrator, the improvement of operational performance expected from ERP does not materialize primarily due to a lack of experience, resource allocation, fragmented data, and lack of clear business requirements and objective direction. You need to choose a firm that has people in-house, has experience with PE projects, and has a rigorous documented methodology. - Engage Early

The Operations Team is already under a tight deadline to deliver results to the Portco, so engage the ERP Integrator as the deal is closing so that the Ops team has enough runway to get full engagement and required materials from the Portco team. - Focus on Data

Failed data migration is a well-publicized issue of ERP projects, focus on data from the get-go, and ensure to focus on migration from requirements to post go-live. Remember, reliable data easily accessed in one place will help highlight where efficiency gains can be made to boost profitability. - Have clear requirements

Get an on-site session planned for a couple of days to really understand the Portco’s business processes. Capture the requirements and solution and leave no stone unturned, ensure all parties are bought-in with what is being proposed prior to kicking off the implementation and objectives are clear. - Plan for Adoption

Executives must be bought in and adoption should be a warm-up process and not a big bang hit after the implementation. All users affected by the ERP MUST be given use-case scenarios to practice throughout the project in order to accommodate for a smooth transition.

Next Steps

INFORMED DECISION MAKING STARTS HERE

- MEET TO ESTABLISH CONTACT Reputation is paramount, we’ll meet to verify we’re a good fit for your team & value chain, go over your ERP needs & establish basic rules of engagement.

- ASSESS PORTFOLIO ERP NEEDS We’ll help you with ERP pitches & proposals along with full project planning and presentations to Portco C-Suite.

- PLAN & CONQUER Dedicated staff will be assigned to know your project approach, this way we can have boots on the ground in no time when needed, whether at your offices or at the Portco’s.

- REVIEW & OPTIMIZE We’re big on lessons learned, after every implementation, we’ll review the nuts & bolts to ensure consistent, quality delivery to your Portcos.

Spotting PE-ERP Opportunity

WHEN TO INVOLVE AN ERP PARTNER TO DRIVE OPERATIONAL VALUE ADD

- Company Class: Mid Market company aiming for rapid growth via optimization of the current state in order to prep for fast scaling.

- PE Deal Flow Stage: Due Diligence, when you’re about to sign the deal and know ERP revamp or implementation is needed.

- Deal size: $10M – $200M.

- Investment Exit Strategy: For instance, if the idea is to sell the company to a bigger public company that might have its own ERP system, then NetSuite makes sense in the interim.

- Timeline & TSA: Aggressive, since NetSuite is a cloud-based ERP, the implementation timeline is way shorter than most ERPs that were not built as a SaaS solution from the ground up. A brisk 100 days can get you live with core operations functioning and reporting clean financial data.

- Multiple Locations: When the portfolio company has locations in multiple states and countries, is growing and needs an accounting system to support multiple currencies and tax jurisdictions.

- Analytics Clarity: When the portfolio company is looking to get insights on multiple transaction types in one place, in real-time, i.e.: sales leads, revenue, outstanding invoices, vendor bills, customers, orders, products for sale, inventory, etc.

- Merger & Acquisition Simplification: Many PE firms integrate major or minor acquisitions into their existing portfolios, this process has to be fast, robust and predictable. In turn, successful PE firms that deal with specific niches, stick to NetSuite ERP for as much of their portfolio as they can in order to have centralized visibility into portfolio performance.

“SO, SHOULD A PRIVATE EQUITY FIRM CARE ABOUT ERP, THE ANSWER IS ABSOLUTELY. POTENTIAL RETURNS OF 10% TO 20% ON EQUITY INVESTMENT COULD BE GENERATED THROUGH OPERATIONAL IMPROVEMENTS BY ERP.”

The Writers

Akash Agrawal

Private Equity NetSuite Consultant

Trajectoryinc.com

Imran Selimkhanov

Trajectoryinc.com

Cheryl-Vijjeswarapu

Private Equity Specialist & Contributor