Private equity (PE) firms seeking to drive growth and operational efficiency across their portfolio companies must focus on creating scalable technology ecosystems. Success hinges on several critical factors: streamlining quote-to-revenue processes to eliminate inefficiencies, ensuring robust data migration for system integrity, and unifying business systems to support rapid expansion.

Additionally, business process redesign plays a pivotal role in optimizing operations, while collaborative implementation between PE firms, portfolio companies (PortCos), and technology partners ensures alignment with strategic goals. Together, these elements form the foundation of a resilient, growth-ready technology ecosystem that can adapt to evolving business demands, as well as seamless onboarding of future acquisitions.

PE firms looking to build scalable technology ecosystems for their PortCos can explore Trajectory’s technology transformation services. In this Insight, we will examine the experience of Sovos Compliance LLC, a worldwide provider of tax compliance and business-to-government reporting SaaS software. Trajectory assisted Sovos in creating a unified technology ecosystem including Salesforce CRM, Oracle-NetSuite ERP, and Boomi integration elements.

In the words of Venu Martha, VP of Business Applications at Sovos Compliance LLC:

“Trajectory worked closely with our Salesforce implementation partner and the Sovos business teams to design and build a streamlined Salesforce to NetSuite architecture that has redefined operations at Sovos. Our project goal was to make “Billing a Non-Event” and this solution has helped us achieve this aggressive goal. Sovos’ quote-to-revenue process is now operating more smoothly and the company is poised to onboard new acquisitions to the unified business processes more efficiently going forward. Trajectory’s integrated consulting and development teams were a value-add, ensuring fluid and efficient implementation of the solution.”

The Power of Holistic Business Process Redesign

For private equity-backed companies, optimizing business processes is key to driving efficiency and value creation. Streamlining core functions, sales, finance, compliance, and operations, enhances decision-making, financial visibility, and scalability, especially during rapid expansion.

Aligning these processes with growth objectives keeps companies agile. Optimized financial reporting enables faster, data-driven decisions, while improved compliance processes help navigate evolving regulations, particularly in multi-jurisdictional expansions.

Eliminating redundancies and automating manual tasks strengthens operational resilience, allowing leadership to focus on growth without being hindered by inefficiencies.

Due Diligence and Scalability: Laying the Groundwork for Growth

A thorough assessment of a company’s existing business processes is a key part of due diligence in private equity transactions. Today, PE firms are moving beyond traditional financial due diligence and adopting a more integrated approach that evaluates not only financial health but also operational scalability, technology infrastructure, and compliance readiness.

For PortCos to scale effectively post-acquisition, they must have flexible, integrated systems in place that can support expansion, whether through organic growth or M&A activity. Without scalable processes, businesses risk operational bottlenecks that can slow revenue recognition, introduce inefficiencies in financial reporting, and create compliance challenges across multiple jurisdictions.

Impact on EBITDA: The Link Between Process Efficiency and Profitability

Operational inefficiencies directly affect a company’s bottom line. Business process redesign not only enhances workflow efficiency but also drives cost savings that positively impact EBITDA, a key performance metric for PE firms.

By automating repetitive tasks, reducing manual errors, and eliminating process bottlenecks, companies lower their operational costs while improving service delivery. In many cases, technology-driven process optimization reduces the need for additional headcount while increasing output, creating a direct, measurable improvement in profitability.

Understanding Business Processes: The Foundation for Successful Transformation

Gaining a clear understanding of a client’s existing business processes and goals is often an overlooked step in the digital transformation process, even though it’s a critical success factor for implementation success. Trajectory, as a business-first partner, focuses on this at the start of all engagements.

In Sovos’ case, Trajectory worked with subject matter experts from the Sales, Sales Operations, Customer Service, and Finance teams to assess existing quote-to-invoice processes and identify opportunities for improvement. By challenging the status quo, we developed streamlined workflows that balanced efficiency, business needs, and technology best practices.

Additionally, given the project’s emphasis on international compliance, ensuring the new processes met or exceeded standards was a top priority.

Project Blueprinting for Value Creation

Business process redesign and project blueprinting go hand in hand. As solution architecture takes shape, refinements to business processes naturally emerge, ensuring that technology and operations align with the company’s strategic vision.

A well-defined project blueprint provides a structured approach to integration, outlining the necessary technology, processes, and team requirements for successful transformation. By establishing a scalable technology roadmap early in the process, PE firms can ensure that PortCo operations integrate smoothly and grow in alignment with their overarching investment strategy.

This roadmap addresses not only immediate integration needs but also anticipates future growth requirements, so that technological systems and processes scale efficiently with the business.

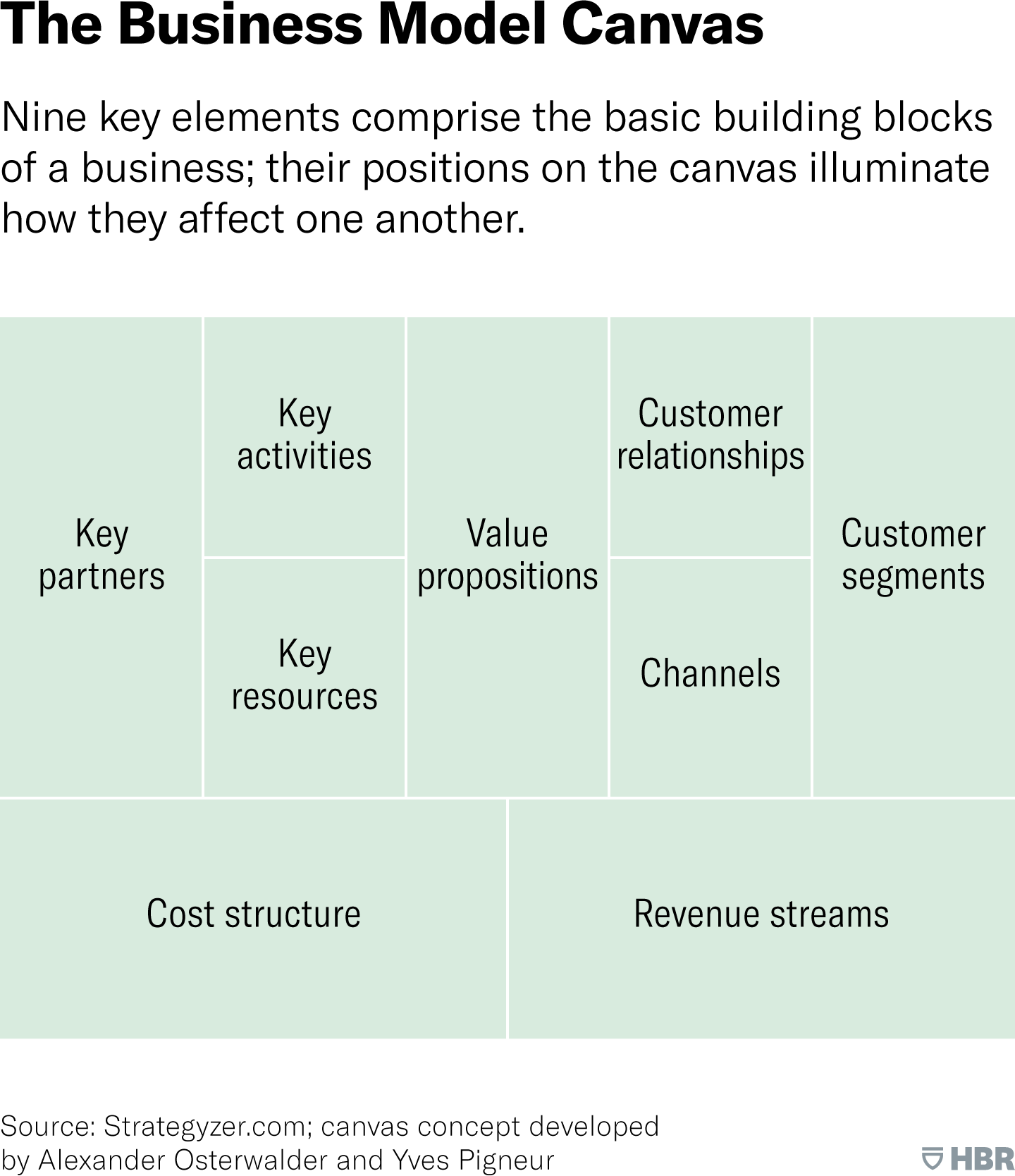

Harvard Business Review highlights the value of the business model canvas, a framework that outlines nine essential elements, to help organizations align technology with broader strategic goals. By focusing on business model evolution rather than simply adopting new technologies, organizations can drive sustainable growth and operational improvements.

Importance of Setting Objectives and KPIs

Clear objectives and key performance indicators (KPIs) help PE firms and management teams track progress, assess effectiveness, and make informed adjustments. However, many digital transformation efforts fail because companies prioritize the wrong KPIs, those that focus on technology adoption rather than value creation.

Deloitte’s ‘Mapping Digital Transformation Value – Metrics that Matter’ report found that focusing too narrowly on specific metrics can limit understanding of transformation success. It underscores the need for a balanced KPI framework spanning five key categories:

- Financial: Revenue growth, cost savings, EBITDA impact.

- Customer/Client: Customer acquisition, retention, satisfaction.

- Process: Operational efficiency, automation rates, error reduction.

- Workforce: Employee engagement, productivity, turnover rates.

- Purpose: ESG impact, brand perception, innovation adoption.

By selecting KPIs that drive measurable business outcomes, PE firms can maximize value creation and ensure long-term success.

PE’s Role in Blueprinting: Defining Milestones and Outcomes

PE firms play a critical role in shaping integration roadmaps, ensuring each stage contributes to sustainable value creation. By collaborating with management, they help tailor blueprints to address both immediate and future needs.

Key responsibilities include:

- Defining integration timelines: Establishing phased rollouts to minimize disruption.

- Outlining progress criteria: Setting benchmarks to measure transformation success.

- Planning for scalability: Ensuring systems can support future acquisitions.

Blueprinting in Action with Sovos

Starting with a clear understanding of Sovos’ processes and goals, Trajectory worked closely with the Salesforce implementation partner to design a seamless quote-to-revenue solution, from sales activities to revenue recognition and reporting.

A key step was identifying business-specific use cases, including any likely future cases, and mapping them across Salesforce and Oracle NetSuite. This approach ensured the solution could adapt as Sovos grew. The detailed blueprint was then rigorously tested through unit and end-to-end validation.

Front-line team involvement in testing was essential. Team members’ hands-on experience ensured rigorous stress-testing of configurations, confirming that the system performed as expected for real-world scenarios.

Data Migration: The Backbone of Successful Systems Integration

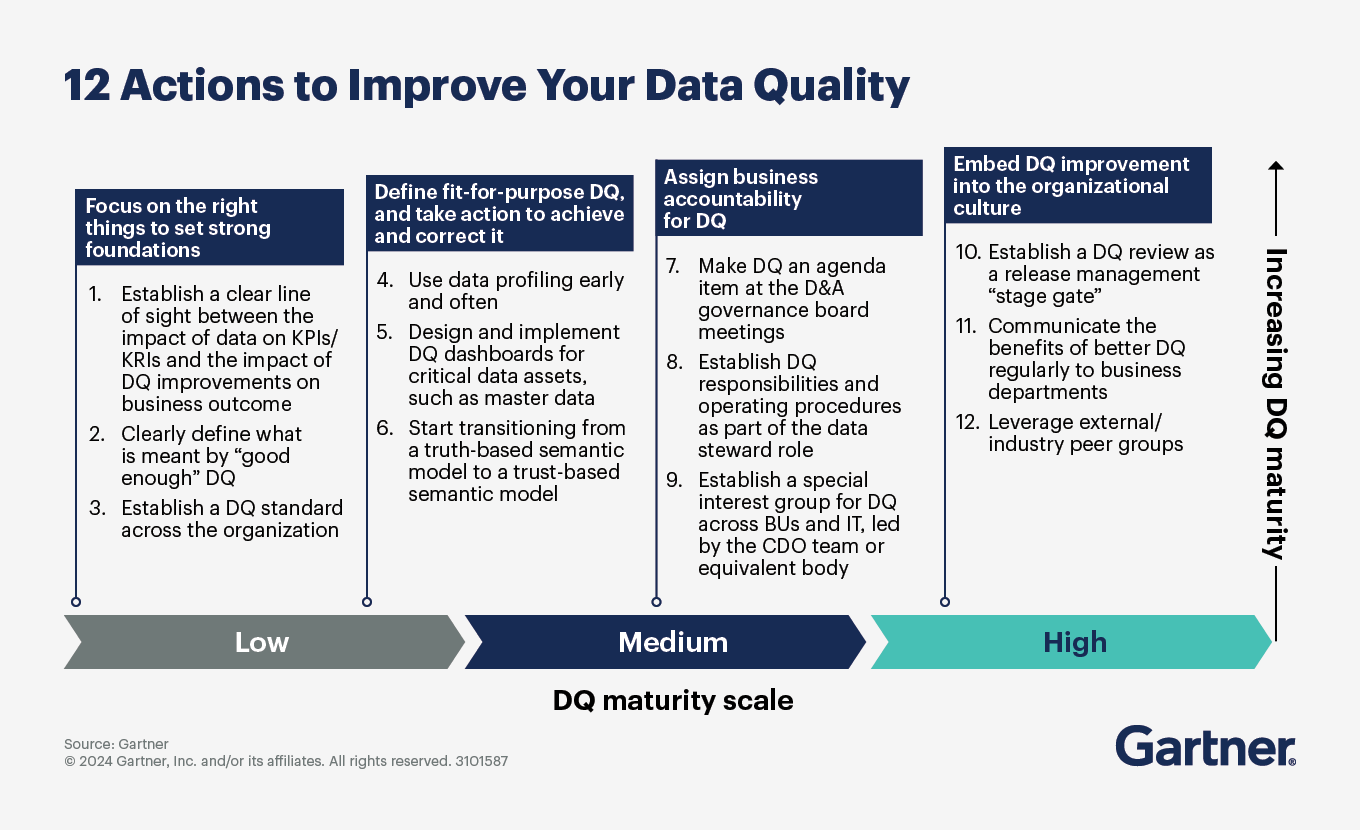

In any technology transformation, data migration is a make-or-break factor. Poor execution can lead to data loss, financial reporting errors, and compliance risks, which can significantly hinder post-acquisition success. Gartner estimates that bad data costs businesses $12.9 million per year, reinforcing the need for a structured data migration strategy.

Data Migration Considerations for Due Diligence Teams

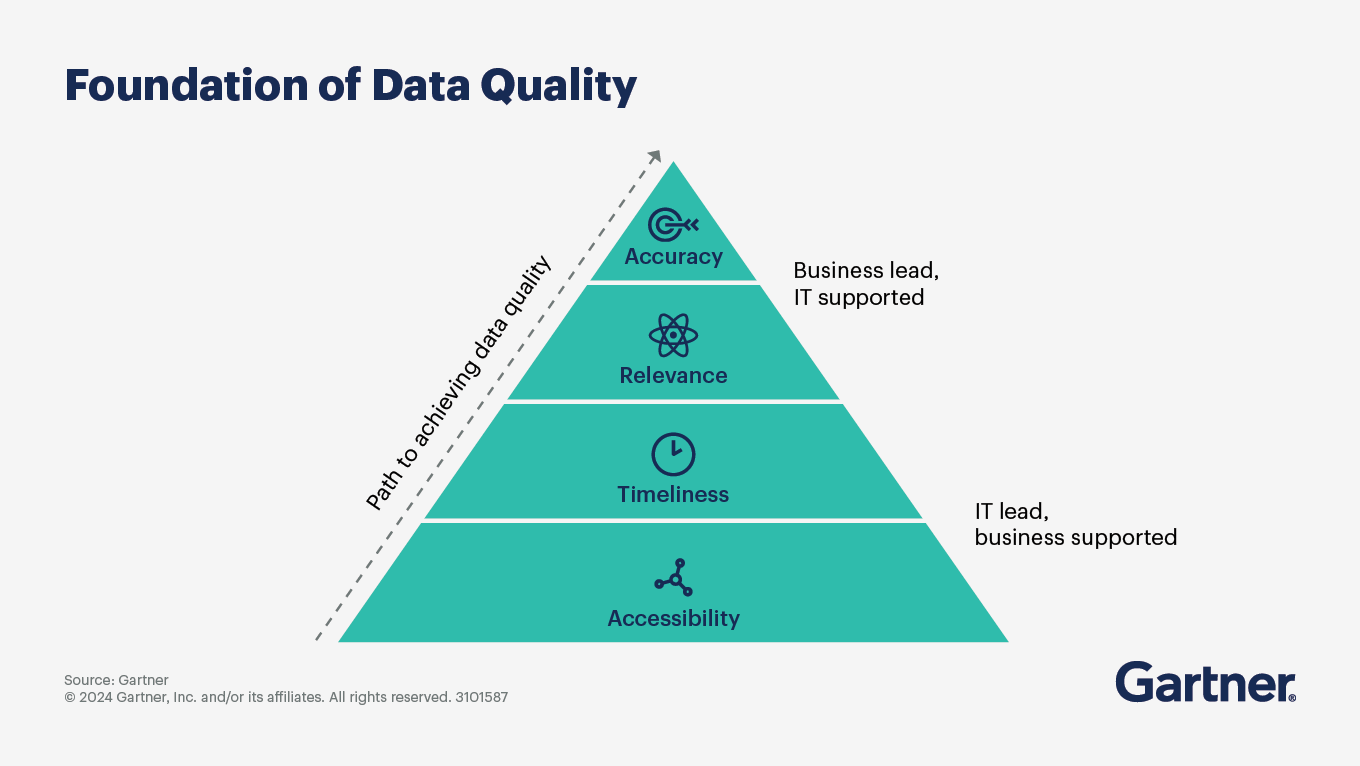

Data quality impacts integration and long-term business value. Gartner’s Data Quality Pyramid outlines four key pillars: accessibility, timeliness, relevance, and accuracy.

Without a sound data quality strategy, PE-backed companies risk integration failures, compliance issues, and operational disruptions. Software AG warns that poor data migration can lead to missing records, downtime, data corruption, security vulnerabilities, and cost overruns.

Best Practices for Ensuring Data Integrity

A structured data migration strategy safeguards data reliability and business continuity.

Forbes and Gartner highlight key approaches:

- Leverage cloud tools early to maintain analytics access during migration.

- Validate data in a staging environment before full migration.

- Create a comprehensive data inventory to prevent mapping errors.

- Establish strong governance with defined quality standards, proactive oversight, and clear accountability.

Long-Term Benefits of Strong Data Foundations

Prioritizing data quality and governance enables scalable growth, faster acquisitions, and better decision-making. A well-executed strategy enhances operational efficiency, regulatory compliance, and interoperability across CRM, ERP, and financial systems. Strong data foundations also support AI and automation adoption, improving business valuation and EBITDA.

By investing in structured data migration, PE firms set their PortCos up for seamless integrations and long-term success.

Data Migration Challenges and Innovations: Lessons from the Sovos Project

For the Sovos engagement, the data migration workstream was the most complex aspect of the project. Data needed to be collected from various sources, cleansed, normalized, and prepared for reloading into the new technology infrastructure. Completing the task required dozens of cross-disciplinary team members consisting of technical team members to collect and extract the data, data analysts to review and normalize the data, and SMEs to validate the data. The number of people and level of effort required to prepare the data was the single most labor-intensive aspect of the project, surpassing even testing efforts.

Clear planning, resource coordination, data prioritization, and timeline management all facilitated by a project manager, as well as multiple rounds of test data loads, were required to ensure implementation success. A strategy that was also used was dividing up the data into datasets based on criticality for Go-Live. Critical datasets were prioritized and completed prior to Go-Live, while secondary datasets were tackled post Go-Live.

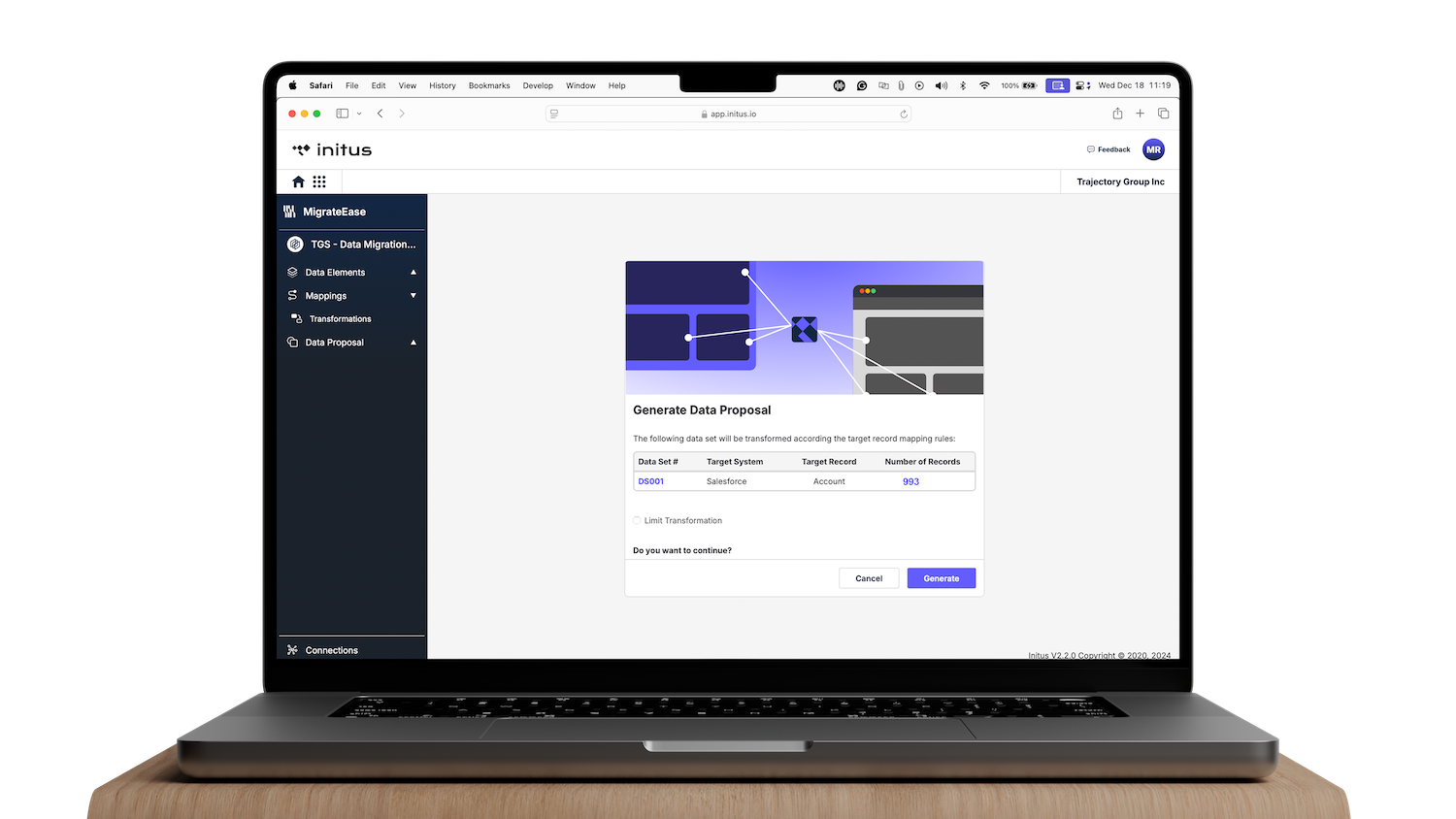

The challenging yet insightful data migration experience encountered during the Sovos project served as a catalyst for Trajectory’s sister company, Initus Technologies, to create the innovative MigrateEase Data Migration tool. This cutting-edge solution is specifically designed to streamline and organize the complex data migration process, making it more efficient and reliable.

MigrateEase: Revolutionizing the Data Migration Process

Utilizing traditional integration techniques, MigrateEase extracts comprehensive datasets from various third-party systems. One of its standout features is a robust visualization layer that enhances the user’s ability to understand and manage the data being migrated. This means that organizations no longer need to rely heavily on Excel for data migration tasks, which has historically been a source of frustration and inefficiency in the process.

MigrateEase harnesses the power of artificial intelligence to identify duplicate entries within the data, ensuring that the final dataset is accurate and clean. Moreover, it consolidates information that may exist across multiple systems, effectively reducing redundancy and enhancing data integrity.

The tool also leverages machine learning capabilities to continuously improve the migration process, adapting its methods based on previous experiences and outcomes. Once the data has been thoroughly prepared, MigrateEase seamlessly transfers it into the target CRM and ERP solutions.

We are genuinely excited about the simplification and enhancement that MigrateEase brings to one of the most critical components of systems implementation: the data migration phase. Its ability to reduce complexities and enhance accuracy means organizations can focus more on their strategic goals rather than getting bogged down in technical challenges.

Moving forward, all implementations conducted by Trajectory will be supported by MigrateEase.

Transformation Team Composition and Governance

A well-structured team is key to a smooth and effective integration in PE-driven transformations. These teams typically include:

- Transformation specialists: Experts in data migration, process optimization, and system integration.

- Internal stakeholders: Key personnel from the acquired company who provide institutional knowledge and ensure alignment with company culture and operations.

- External consultants: Industry specialists who provide technical expertise and strategic insights.

However, successful transformation goes beyond assembling the right team, success also depends on team dynamics. EY emphasizes six human-centered transformation drivers:

1. Strong leadership skills and emotional intelligence (EQ).

2. A clear transformation vision (“Pole Star”).

3. Collaborative, co-creative team culture.

4. Involving people in the change process, rather than imposing change on them from the top down.

5. Technology as an enabler, not just a tool.

6. Empowerment through autonomy, experimentation, and incentives.

The Evolving Role of Operating Partners in PE Transformations

Operating partners ensure alignment with investment goals, oversee transformation progress, and manage strategic risks. PwC notes that their role has evolved from financial engineering to operational value creation, from 51% in the 1980s to 25% today, with a focus on cost management, talent retention, and leveraging technology for insights.

Aligning Stakeholders Through Communication and Project Management

Seamless integration requires clear and consistent communication across all involved parties, including management, PE firms, and third-party vendors. Poor communication can lead to misalignment, delays, and inefficiencies, which, altogether, can cost companies an average of $62.4 million per year.

Communication best practices include:

- Establish centralized reporting channels: Ensures real-time updates and transparency.

- Define clear escalation paths: Minimizes delays in decision-making.

- Conduct regular alignment meetings: Keeps all stakeholders informed and accountable.

💡 Choosing the right project management approach also impacts success. Agile is ideal for fast, flexible transformations, while Waterfall works best for structured, compliance-driven processes. Aligning the methodology with transformation goals ensures seamless execution and measurable value creation.

How Sovos Balanced Agile and Waterfall Approaches

For Sovos, managing a large-scale transformation with over 100 stakeholders required a structured yet flexible approach. The project involved various business teams, executives, implementation partners, project managers, testers, and a data migration task force.

Although there was a defined project team structure with representation from all impacted departments, the key to overall project success was a central project manager who ensured task clarity, resource availability, and timely execution.

To achieve both predictability and adaptability, we employed a hybrid approach:

- The solution build followed a structured Waterfall schedule to ensure clear milestone tracking.

- In parallel, iterative Agile testing cycles allowed for continuous validation and refinement.

Scalability as a Key Metric for Future Expansion

For private equity firms, scalability is essential to ensuring that systems, processes, and resources can support rapid expansion and seamless integration of future acquisitions. A scalable infrastructure enhances operational efficiency, adaptability to market changes, and sustained business growth.

Without a scalable foundation, PortCos may struggle with inconsistent processes, technology bottlenecks, and inefficiencies that limit their ability to operate effectively and expand.

Tech-Enabled Scalability: Leveraging Cloud-Based CRM and ERP Systems

To achieve true scalability, modern cloud-based CRM and ERP systems, and automation tools play a crucial role. These technologies enable PortCos to scale across multiple locations and geographies while maintaining operational consistency and compliance. Key benefits include:

- Multi-location support: Ensuring smooth operations across different regions.

- Cross-border adaptability: Helping companies navigate international regulatory environments.

- Seamless data integration: Unifying financial, operational, and compliance data for better decision-making.

However, technology alone is not enough, a structured approach to post-acquisition integration is equally critical.

A Standardized Post-Acquisition Approach for Scaling New Add-Ons

To streamline scalability, PE firms increasingly rely on a structured post-acquisition technology transformation playbook. This standardized framework ensures that each newly acquired company quickly aligns with the firm’s operational and technology standards, allowing for faster integration and long-term scalability.

A well-developed integration playbook accelerates onboarding and streamlines operations, driving rapid value creation. Key elements include:

- Initial audit: Identifies scalability gaps and key risks.

- IT system alignment roadmap: Standardizes processes across the portfolio.

- Regulatory compliance checklist: Ensures adherence to jurisdictional requirements.

While standardization is crucial, McKinsey cautions that a rigid, one-size-fits-all approach can be counterproductive. A flexible framework allows firms to tailor integrations based on company-specific factors and industry best practices.

Scalability in Action: The Sovos Example

Similar to how PE firms use a playbook to integrate new PortCos swiftly, Sovos’ technology ecosystem was designed and built for scalability, anticipating frequent future acquisitions.

By developing a system that could accommodate seamless onboarding, Sovos ensured new entities could be integrated efficiently without operational disruptions. In fact, a new acquisition was integrated within eight months of the new system’s Go-Live.

Blueprint for PE-Backed Technology Transformation

In the rapidly evolving private equity landscape, scalable technology transformation is not just an operational necessity, it is a strategic advantage. As demonstrated through the Sovos Compliance LLC case study, a well-structured technology ecosystem built on Salesforce CRM, NetSuite ERP, and Boomi integration can significantly enhance efficiency, streamline processes, and drive measurable value.

The key success factors outlined in this paper, holistic business process redesign, rigorous project blueprinting, and seamless data migration, serve as the foundation for scalable, acquisition-ready growth. By prioritizing process optimization, PE firms ensure that portfolio companies achieve operational agility, financial transparency, and regulatory compliance. Furthermore, a well-defined project blueprint enables organizations to integrate new acquisitions seamlessly, while high-quality data migration safeguards system integrity and decision-making capabilities.

For private equity firms, success is measured not only by EBITDA growth but also by their ability to rapidly scale and integrate portfolio companies, as well as a PortCo’s capacity to rapidly incorporate new acquisitions. A structured approach to technology transformation, coupled with clear KPIs and governance, ensures long-term value creation. By investing in scalable, future-ready technology ecosystems, PE firms can accelerate operational synergies and establish a sustainable competitive edge.

Technology transformation is not a one-time event, it is an ongoing strategy that fuels long-term growth and maximizes value across the investment lifecycle.

Alex Olano

CEO, Managing Partner

Throughout his 18-year career at Trajectory, Alex’s role has ranged from managing teams and projects to running the professional services organization, and mentoring Trajectory’s growing number of Consultants. Currently, he leads the Trajectory Team and invests his time ensuring Private Equity avoids key technology risks during their transactions. Alex understands technology is simply the means for achieving business goals. He has guided Trajectory’s organization to form its own version of Operational Improvement, which combines industry and business acumen with highly effective technology implementation capabilities. Prior to joining Trajectory Group, Alex spent 10 years in business consulting, systems advisory, and SAP implementations with IBM Global Services and Accenture.