Ask any accountant from any organization around the world – regardless of company size – which tasks they are least likely to look forward to, and you can be certain the vast majority will say closing accounting periods!

The good news: given the importance of period closing activities, specialized platforms have now been developed to help accountants and controllers perform these tasks with a greater degree of confidence. Let’s find out what this really means, and how it’s done in NetSuite.

- Time to read: 12 min

- Drink pairing: A glass of Moët & Chandon to celebrate a timely and accurate month-end close

- You are a: CFO, Controller, Accounting Manager.

- For immediate support: if you need a demo, or immediate contact us & we’ll reach out asap

NetSuite Financial Close

If are using NetSuite as your ERP system, then you know that you have complete control and visibility over your core accounting processes. Managing aspects of your business like Revenue Recognition, Accounts Receivable, Accounts Payable, and Bank Reconciliation is NetSuite’s strong suit – and one of the main strengths that separate it from the herd.

Of course, being a platform that is designed to be your accounting engine, and source of financial truth, NetSuite does have built-in functionality that will assist you in your month-end close process – which we will walk you through. You’ll find out that there is usually MORE to the close than what NetSuite allows you to do.

As a result, we will explore another neat application – FloQast, it makes financial close easy as pie – and how it gels with your NetSuite instance.

What is so complex about the month-end closing process in accounting?

Before we dive into the period closing functionality in NetSuite, let’s review why the month-end close is such a difficult part of the accounting cycle.

- Lack of standardization – While there are certain tasks that all companies perform as part of their month-end close (for example, bank reconciliation), there are a large number of tasks that will vary from one company to another. Most of the time, the required tasks are specific to an individual company, and knowledge of these tasks resides with key employees. These processes are typically not documented, making it difficult to organize the month-end close between different members of an accounting team.

- Length of time required – A major challenge that companies face with month-end close is the sheer amount of time that it takes to close out a month. In a study performed by APQC, the median number of days required for month-end close was 6.4. As a result, this is the time taken away from accountants that could be used to perform analytical and forward-looking work.

- The number of tasks – In most organizations, the month-end close usually involves a large variety of tasks that need to be performed. This often leads to transactions or activities being missed or overlooked, and these can be a real pain to revisit at a later point in time.

- Lack of automation – the process of closing the books is, by and large, a labour-intensive process. Most companies do not have automation to close their books, and the financial data needed to perform

reconciliations is scattered among multiple source systems or numerous excel spreadsheets! There is still a heavy reliance on people to coordinate and perform repetitive tasks. - Access to data – Accessing the vital sources of data that accountants need in order to successfully close their periods can be difficult. This is because of the presence of multiple source systems, and also because departments and segments are scattered across multiple locations, meaning that accountants need to share documents via email, causing further delays in the close. Cloud storage solutions like Box and Dropbox certainly have helped with this, but many organizations still haven’t adopted these types of solutions.

Having looked at the above challenges, you would be hoping that the accounting software you invest your company $$s in would be able to help resolve some of these issues! In fairness, that assumption wouldn’t be too far off the truth. Let’s dive in and find out how you can close a month in NetSuite…

The financial close solution in NetSuite

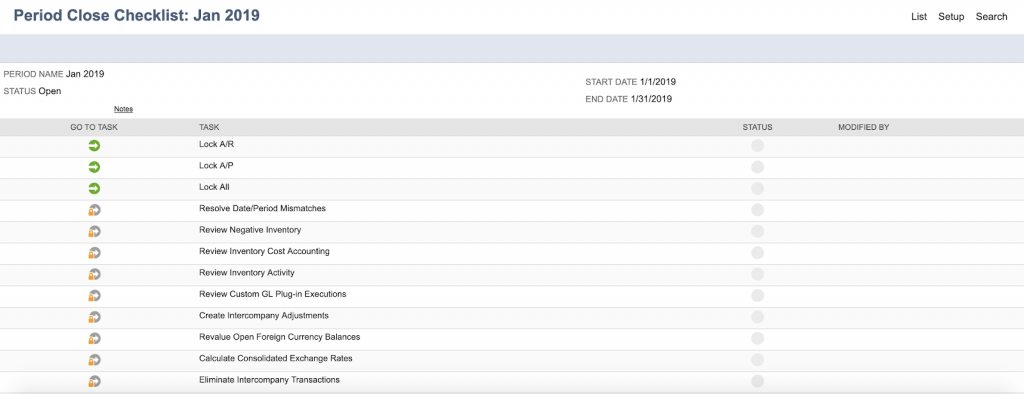

NetSuite has a Period Close Checklist that accountants must go through in order to close a month. Below I’ll take you through each of the steps in this checklist, and add some colour to what those steps really mean in NetSuite!

Good to know: Pretty much every accounting software out there has some form of period close functionality built into it, or at the very least will make it possible for accountants to perform their period closing tasks.

NetSuite Financial Close Process

Let’s start off by listing the items that can be found on the NetSuite Period Close Checklist. Something to keep in mind about this checklist is that the items need to be completed in the order that NetSuite lists them in. While the tasks listed are applicable to all companies, most accounting teams, from a business process standpoint, will not necessarily complete them in the order that NetSuite lists them in.

Apart from the first three tasks, the remainder of the tasks have buttons labelled “Mark Task Complete” to prevent duplicating a task. The following three areas must be locked before the remainder of the list can be addressed:

| Task | Check |

| Lock A/R | ✅ |

| Lock A/P | ✅ |

| Lock All | ✅ |

Once those tasks are locked, the tasks below must be addressed in order to be able to close the period. Each of these tasks has a button called “Mark Task Complete”, which will indicate to the rest of the accounting team that this activity has been completed, and allows you to then move on to the next item in the list.

| Task | Check |

|

✅ (“Mark Task Complete” Option) |

| 2. Review Negative Inventory | ✅ (“Mark Task Complete” Option) |

| 3. Review Inventory Cost Accounting | ✅ (“Mark Task Complete” Option) |

| 4. Review Inventory Activity | ✅ (“Mark Task Complete” Option) |

| 5. Create Intercompany Adjustments | ✅ (“Mark Task Complete” Option) |

| 6. Revalue Open Foreign Currency Balances | ✅ (“Mark Task Complete” Option) |

| 7. Calculate Consolidated Exchange Rates | ✅ (“Mark Task Complete” Option) |

| 8. Eliminate Intercompany Transactions | ✅ (“Mark Task Complete” Option) |

| 9. Close (Period) | ✅ (“Mark Task Complete” Option) |

Here is a visual of what this actually looks like in NetSuite

Now let’s go through the steps to get a better understanding of what they represent we’ll also outline ways in which your accounting teams can get around the order that they are listed in, as well as some really cool tips on how to speed up your close in NetSuite for each of the items in the checklist

1. Lock A/R

Most companies prefer to determine their sales and revenue numbers as soon as the period ends. Here’s why:

- It ensures that the invoices are in customers’ hands to be paid, and provides a view of how effective the selling process is.

- It also allows for a review to ensure all appropriate revenue has been recognized.

Once the sales and revenue numbers for the month have been finalized, companies will close the Accounts Receivable function to prevent any sales or revenue amounts from being inappropriately recorded in the period being closed.

Pro Tips:

- Although Sales Orders or Invoices can be dated in closed periods, (if the option is enabled), they will be posted to the first available open period.

- Customer receipts will need to be up to date in order to lock A/R. If receipts are not up to date, then A/R will need to be opened at a later date to accommodate this.

- Where services are performed and not invoiced, such as milestone billing projects, companies can post journal entries to accrue revenue and post the receivable to Work-In-Process or Other Receivables, as the customer is not obliged to pay until invoiced. This means that the Accounts Receivable sub-ledger does not need to be opened and the sub-ledger will only contain invoiced amounts. The Journal entries accruing revenues will ultimately be reversed in the period that the actual billing occurs.

2. Lock A/P

Most companies will set deadlines for vendor invoices to be submitted into A/P for processing and payment related to the prior month’s activity. Once all of these vendor invoices have been entered, the A/P ledger will be closed to allow for the review of results and the processing of payments to vendors.

Typically, any material invoices received after A/P is locked, related to the period being closed, will be accrued by journal entry and reversed in the following period. These accruals are calculated by the Accounting team based on the knowledge of the business and understanding what goods and services have been received.

Take Note: Although Purchase Orders or Vendor bills can be dated in closed periods, (if the option is enabled), they will be posted to the first available open period.

3. Lock All

Now that your A/R and A/P are locked, your accounting team will typically review the results and make sure that all appropriate standard entries and recurring entries have been made in order to close the period. The “Lock All” option will primarily prevent any accounting staff from recording any more entries into the period being closed.

Take Note: Remember the point we made earlier about companies not typically going through the checklist in the order that it is outlined? Well, this is a very good example of that, where some companies may not actually lock their G/L until late in the close process, as they may want to reconcile some sensitive accounts such as cash (bank reconciliation) and intercompany accounts, prior to closing.

Unfortunately, you can’t progress through the checklist until you actually “Lock All”

4. Resolve Date/Period Mismatches

So, now that you’ve locked your G/L, and no more transactions can be posted in your current period, you move on to review any transactions that may be dated in your current period but were inadvertently posted in another period. This process needs to be done in order to ensure that transactions have not been posted to an incorrect period.

Let’s visualize this with an example. Say you have, an invoice that is dated July 2016, but is posted to the September 2016 period, then it will need to be reviewed. In this case, if you are closing in July 2016, then the posting to September 2016 might actually be incorrect. A review would need to be done to see if the posting period needs to be adjusted.

Take Note: If you are closing September 2016, then this could be legitimate in cases where an invoice is reissued in September 2016 for an error that occurred in July 2016 (closed period) and you don’t want to restart the ageing of the invoice to the customer. If this is the case, there should be a credit memo offsetting the original July 2016 invoice, posted in September 2016.

Pro Tips:

- If you want to prevent mismatches from ever occurring, NetSuite has a feature that allows you to restrict users from entering a transaction with a date that is outside the posting period selected. This, of course, will reduce the amount of work that will need to be done come month-end!. However, before enabling this setting, do keep in mind the example we gave above under “Important”, as that might be an example of a situation where you need to post to a period that is different from the transaction date.

- If you wish to review these before the month-end closing process, you can set up a saved search to review mismatches regularly in order to complete this task well ahead of the month-end close. This is an awesome way to reduce your time to close!

Good news: When resolving Date/Period Mismatches as part of the month-end close, one of the cool features NetSuite has is that it automatically brings up a list of transactions that have a mismatch, so that you can review and address them one by one with relative ease.

5. Review Negative Inventory

If you are a company that carries physical inventory, then this is a task you will have to perform. Here, you are investigating why any inventory items went into a negative position at the period end and making the required adjustments.

Pro Tips:

- The negative inventory indicates that a process issue may exist. Typically, this may mean that a receipt of goods has not occurred or a shipping document to a customer has overstated what was shipped. This step is important, as once Netsuite has an inventory item go into a negative position, any shipments of that item will be recorded at zero cost, which will understate your cost of goods sold.

- If you would like to perform this task before the month-end closing process, you can set up a saved search that brings up a list of items that have negative inventory throughout the month. This means you can address them periodically, allowing you to complete this task well ahead of the month-end, and reducing your time to close.

6. Review Inventory Cost Accounting

In this step, you are ensuring that all appropriate costs have been picked up on inventory transactions and that the inventory costing calculations have been completed for the month. This step may also identify scenarios where inventory transactions have been posted in the wrong period or incorrect costs have been allocated. An example would be someone miskeying a vendor invoice for $600.00 per unit vs. $6.00 per unit – I mean, we are human after all, and mistakes like that DO happen.

Tip: If you would like to review these before the month-end closing process, you can set up a saved search that will allow you to review inventory cost accounting regularly in order to complete this task well ahead of the month-end close.

7. Review Inventory Activity

This process is done to ensure that there are no unusual inventory fluctuations, which again would indicate that a process issue may exist.

Here’s an example – Say you sell an item – Widget A – and you usually keep around 100-150 units of Widget A on hand. As part of the Review Inventory Activity process, you realize that you have 1,000 units of Widget A in your on-hand inventory when going through the report. You can now investigate this issue, and find out if you really do have 1,000 units on hand. Chances are that upon receiving the inventory, the receiver has posted 1,000 units instead of 100 units!

Pro Tip: As is the case with the above processes in the Period Close Checklist, you can set up a saved search to review inventory activity regularly in order to complete this task well ahead of the month-end close.

8. Create Intercompany Adjustments

This process applies specifically to companies that have more than one legal entity they are accounting for, and that use a Parent and Subsidiaries structure. These companies will typically have intercompany accounts to record transactions that occur between the legal entities. For example, a Parent Company provides services to one of its subsidiaries.

In a case like this, the sale would be recorded in the Parent and the cost would be recorded in Subsidiary, using intercompany accounts. The issue is that from a consolidated reporting perspective the transaction has zero value to the consolidated entity. Therefore, when closing, the revenue and cost accounts would be eliminated when consolidating at each period’s end.

Netsuite allows for a certain time and expenses to be allocated across subsidiaries. In order to complete these allocations, intercompany adjustment journals need to be processed.

In many cases, companies will do journal entries during the month to ensure that the intercompany accounts stay in line. If that is the case, then entries automatically prepared by Netsuite may not be required.

Pro Tip: This feature in Netsuite, for intercompany expenses, can be changed from “Allow Auto Adjust” to “Allow”. This should be reviewed with the Finance team to determine if they want Intercompany Adjustment Journals to be set up automatically.

9. Revalue Open Foreign Currency Balances

Any company with foreign currency balances will need to revalue its current assets and liabilities to reflect the period-end foreign exchange rates, as per Generally Accepted Accounting Principles (GAAP). In many cases, the Accounts Receivable and Accounts Payable will hold foreign currency balances. This process will typically be done after locking A/R and A/P. Any foreign currency bank accounts would likely be revalued after the bank accounts have been reconciled.

Take Note: This process should be done for each legal entity (subsidiary), especially where the base currencies differ.

10. Calculate Consolidated Exchange Rates

If you are a Parent company with legal entities denominated in a foreign currency, (e.g. Parent in USD, Subsidiary A in GBP and Subsidiary B in AUD), you will need to consolidate your results using up-to-date foreign exchange rates!

Pro Tips:

- Set rates as early as possible: Given the need to reconcile intercompany accounts with different currencies, setting these rates needs to be done early in the period-end close process. Many companies calculate and set these rates as soon as the period end rate is known. The three rates used for consolidation are:

- Current: this is the rate at month-end and is applied to current assets and current liabilities.

- Average: this is the average rate during the month and is applied to revenues and expenses.

- Historical: this is the rate applied to long-term assets, usually fixed assets, and long-term liabilities – although long-term liabilities are typically adjusted for quarterly or annual reporting.

- If an item is tagged with a historical rate, it will not be updated in future periods. Any required adjustments will need to be done via a journal entry.

While Netsuite will calculate these rates, many companies prefer to calculate these rates themselves, since the Average and Historical rates in Netsuite are calculated using actual transactions posted in the system. This may skew the rates unintentionally due to the timing of the entries.

11. Eliminate Intercompany Transactions

In situations where the intercompany transactions do not offset when consolidating, eliminating entries will need to be recorded manually. A common example of this is when a Parent Company records ownership in a Subsidiary as Investment, while the Subsidiary records the Parent’s ownership as Common Stock (shares).

When consolidating the results, a journal entry would be required to eliminate the Investment and the Common Stock. Any entries of this type are usually known well ahead of time and typically booked manually.

Good news: NetSuite can also be set to create eliminating entries, which means this task must be performed prior to the month-end close. These entries will be generated by NetSuite based on intercompany transactions entered throughout the period where individual lines are marked as “Eliminate” for month-end.

Pro Tips:

- This is the only process in the month-end close that cannot be performed out of sequence.

- That being said, you can preliminarily close all the prior steps to run this process and then reopen the prior tasks to perform them, if need be.

12. Close Period

Almost there! Now that you’ve reviewed all the necessary processes on the checklist, the final step is to close the accounting period. This will prevent any other transactions from being posted to this period.

If you are a company that has multiple operating subsidiaries, and one subsidiary is delayed in closing, you could encounter issues if entries are posted after reports have been issued to management. It is important to maintain a consistent close schedule to prevent transactions from being posted to the wrong period, which will result in inaccurate reporting.

Take Note:

- If you are using the Multi-Book Accounting feature in NetSuite OneWorld, then this process can be done for each Accounting Book separately, or you can choose to close the period for all accounting books at the same time by selecting, “Accounting Book = All”.

- This can also be done for all subsidiaries at one time, or each subsidiary separately.

- The above decisions should, of course, be reviewed carefully with the Finance team to determine whether they want centralized control of the process or for each legal entity to be accountable. It typically depends on the corporate structure and the ability of staff to follow the schedule.

13. Allow Non-G/L Changes

To be clear, this is actually not a specific step in the Period Close Checklist, BUT it is a very useful checkbox that you can set when closing the period. You can change certain Non-G/L related fields, (e.g. PO numbers, Addresses), by putting a checkmark in the box in the Base Period screen. Any user with permission to make Non-G/L Changes will then be able to make those types of changes to records in a closed period. This is especially useful to correct notations on Invoices or revise descriptions instead of having to credit and reissue invoices.

Pro Tip: If you end up using this feature, then, please be aware that if you check this box for a given base period, then each time you go into a specific period to unlock a task, this flag may reset to disallow Non-G/L changes, (i.e. setting removed). So, be SURE to check that box again after locking the task!

CONGRATULATIONS! You have just successfully completed your first-month end close in NetSuite

Pro Tip: Here’s how you can access the Period Close Checklist in your NetSuite account:

- On your NetSuite home screen, navigate to Setup > Accounting > Manage G/L > Manage Accounting Periods

- Then, select the accounting period that you would like to close, and let the fun begin

Month End Close Checklist

Now, we mentioned throughout this post that the sequence in which the NetSuite Period Close Checklist lists the required tasks is not very practical from a business process standpoint. What we’ve done in the below table is change their order, based on our experience, and direct you on how you can get around that order in NetSuite as an alternative.

All but “Lock A/R”, “Lock A/P” and “Lock All” have the “Mark as Task Complete” Option that can be used, if the task has been completed.

| Step | Process | Check |

| Calculate Consolidated Exchange Rates | List > Accounting > Consolidated Exchange Rates | |

| Create Intercompany Adjustments | Transactions > Financial > Create Intercompany Adjustments | |

| Lock A/R | A/R must be locked from the Period Close Checklist | |

| Lock A/P | A/P must be locked from the Period Close Checklist | |

| Calculate Consolidated Exchange Rates Revalue Open Foreign Currency Balances | Transactions > Financial > Revalue Open Currency Balances | |

| Resolve Date/Period Mismatches | Create a Saved Search | |

| Review Negative Inventory | Create a Saved Search | |

| Review Inventory Cost Accounting | Create a Saved Search | |

| Review Inventory Activity | Create a Saved Search | |

| Lock All | All (G/L) must be locked from the Period Close Checklist | |

| Eliminate Intercompany Transactions | If this has been completed prior “Mark as Task Complete” Option, when locking the period | |

| Close Period | Period must be closed from the Period Close Checklist | |

| Check “Allow NON-G/L Changes”, |

If this functionality is needed, the checkbox can be found on the “Close Period” screen. Setup > Accounting > Manage G/L > Manage Accounting Periods > Close > Allow Non-G/L Changes |

Is the NetSuite Period Close Checklist Enough?

- NetSuite is solid at covering the basics. This may be enough for a business that has straightforward processes or is small enough that the close can be easily managed by a few people. However, most businesses (depending on the complexity of their processes) will typically have to do a lot more to successfully go through a month-end close – on time, AND satisfy audit requirements! This means that WAY more tasks will have to be coordinated and managed than those that are outlined in the NetSuite Period Close Checklist.

- It will diagnose problems & figure out that something went wrong in your business process over the last month. For example, checking whether or not you have any items that are reporting negative inventory. BUT, what it doesn’t do is tell you what actions or steps you need to do in order to fix that.

- The period close checklist isn’t all inclusive as there are many more activities the accounting team needs to take on, the question then becomes, how and where do you track these additional tasks? The majority of companies will do this in excel spreadsheets. This, of course, adds much more complexity to an already stressful process.

- Use FloQast..immediately – NetSuite has suite apps that add tremendous value to your business processes, for the period close, FloQast is definitely the top close management software.