The PE Imperative & The Implementation Gap

When it comes to Private Equity (PE), time is the ultimate currency. Every day post-acquisition is a race against the clock to realize the investment thesis, drive operational improvements, and prepare for a lucrative exit (PE firms) or long-term hold success (Family Offices).

The mandate is clear, accelerate value creation. This demanding environment necessitates a specialized ecosystem of partners, from strategic consultants to global accounting firms, all aligned to optimize the portfolio company (PortCo) from day one.

These marquee advisory firms, the strategists, the financial engineers, and the due diligence experts, like West Monroe Partners and major accounting and advisory practices, are indispensable. They lay the foundational blueprint for growth, identifying key EBITDA levers, outlining operational efficiencies, and structuring the deals. They define the “what” and the “why”.

However, defining the strategy is only half the battle. The critical gap, the chasm between strategic aspiration and measurable outcome, is often found in the “how”. The how is the complex, meticulous, and high-stakes work of technology implementation and integration. This is where systems are chosen, processes are re-engineered, and data is unified to create a foundation for scalable growth. This implementation phase is too often a bottleneck, jeopardizing timelines and eroding potential returns.

Recognizing this critical pivot point, the world’s leading PE advisory vendors have turned to a specialized partner, a high-velocity execution engine to close this gap, Trajectory. We are a key technology implementation partner for the consultants and accounting firms PE and Family Offices trust most, ensuring their brilliant strategy translates flawlessly into sustainable technological reality. Our expertise allows our partners to deliver their value proposition faster, more reliably, and with greater depth, securing a competitive edge in the highly-leveraged PE and Family Office landscape.

The Consulting Ecosystem & The Value of Focus

The Private Equity and Family Office advisory market is a finely segmented ecosystem, where specialization yields excellence. Strategic consulting firms excel at the Macro view: M&A transaction services, carve-out strategy, commercial due diligence and high-level operational strategy. Accounting firms, with their deep expertise in finance, risk, and compliance, own the Financial view: technical accounting, tax structuring, audit readiness and post-merger accounting integration.

Both are tasked with identifying technology requirements. For example, a strategic partner might determine that a PortCo needs a single, unified enterprise resource planning (ERP) system to achieve standardized financial reporting and close faster post-close. An accounting firm might highlight the need for a system robust enough to handle complex revenue recognition or multi-entity consolidations.

But their core competency, and their greatest value to the PE firm or Family Office, is strategy and financial architecture, not the meticulous, technical, often messy work of integrating a new NetSuite ERP, rolling out a Salesforce CRM across newly acquired entities, or migrating mission-critical data in a divestiture.

This division of labor is essential for efficiency. When a strategic firm like Kaufman Rossin dedicates its resources to complex project management and high-level strategy, they need a trusted technology expert to handle the meticulous execution. Trying to maintain an in-house team of world-class, high-speed NetSuite and Salesforce implementation specialists is costly and often sub-optimal for a strategy-focused practice.

This is the very nature of the partnership, Trajectory steps in as the dedicated, high-speed implementation arm. We shoulder the burden of execution risk, freeing the strategic partners to focus on their unique, high-value advisory work. By functioning as a seamless extension of our partners’ practices, we ensure the PortCo receives both world-class strategic planning and world-class technological execution, all within the compressed timeline mandated by the investment clock.

Trajectory’s Unique Position as The Implementation Specialists

Trajectory has cultivated a unique position in the PE and Family Office ecosystem. We are the implementation experts chosen by the experts, with deep, ongoing, and proven partnerships built on trust, precision and velocity.

In this ecosystem, a firm like Kaufman Rossin establishes the financial foundation that sophisticated family offices and investment platforms depend on. As these organizations navigate growth, restructuring, or the launch of a new fund, Kaufman Rossin provides the steady hand, designing accounting structures, standing up fund administration workflows, ensuring compliance, and building the reporting frameworks investors and regulators rely on. Their work defines the operating model, while Trajectory brings that model to life in the systems that must scale and perform on Day 1.

That same complement extends to complex transactions. Consider the demands of a carve-out or divestiture. A firm like West Monroe leads the separation strategy, detangling legal entities, defining Transition Services Agreements (TSAs), and structuring the new standalone organization. As West Monroe’s Director of Mergers & Acquisitions, Keith Campbell, explains, their mandate is to “detangle data and establish a standalone technology platform… and exit costly transition services agreements quickly and seamlessly”. Their team sets the strategic blueprint, while Trajectory ensures it materializes in the operational systems that enable independence.

This is where Trajectory becomes indispensable. We transition from strategy to execution with surgical precision, specializing in the foundational systems critical for any standalone entity, Salesforce CRM and NetSuite ERP.

A Case Study in Seamless Partnership: Strategic Diligence to Execution

Our collaboration often begins upstream, during the pre-diligence phase, working directly alongside the strategic consultants:

- Digital Due Diligence & Systems Integration Roadmapping: While the strategic partner assesses market viability, Trajectory performs the crucial Digital Due Diligence. We look under the technological hood, assessing IT risk, digital readiness, and system architecture for over 35 pre-diligence engagements with key partners. We deliver a concrete CRM and ERP blueprint and a clear integration roadmap. This turns IT assessment from a liability discovery exercise into a concrete value-creation plan, which the strategic consultant can then confidently present to the deal team.

- Implementation Expertise as an Advisory Service: Strategic firms often utilize Trajectory’s expertise to strengthen their own advisory services. For M&A transactions, Trajectory helps partners conduct fit-gap analyses, provide tailored CRM/ERP demos, and assist in designing scoring logic for solution selection. This ensures the technology recommended by the strategic partner is not just theoretically sound, but perfectly executable by our world-class implementation team.

- High-Velocity Deployment: Post-close our role accelerates. Whether it’s executing a full NetSuite implementation for a new standalone entity (to quickly exit the seller’s TSA) or standardizing Salesforce across three newly-acquired PortCos, Trajectory’s methodology is designed for the PE timeline. We turn the strategic blueprint into a functioning, scalable system faster and with less risk than any generalist team.

This collaborative model is the true engine of accelerated PE value creation. The strategic partner sets the target, Trajectory ensures the rocket is built and launched perfectly.

Real-World Execution: The Knox Company Transformation

To see this partnership in action, look no further than The Knox Company (read full case study here). Facing a stalled migration from a legacy Microsoft Dynamics AX system, Knox needed a rescue team. Partnering with West Monroe, Trajectory stepped in to execute a high-complexity NetSuite implementation tailored to Knox’s unique “make-to-order” business model.

While West Monroe managed the strategic alignment and project rigor, Trajectory’s technical team built the custom logic required to handle intricate jurisdictional product configurations and automate financial settlements. The outcome was a complete turnaround, from frequent system crashes to near-zero downtime, and from manual bottlenecks to automated efficiency. This collaboration illustrates exactly why top PE advisors rely on Trajectory, we turn their strategic blueprints into functioning, high-value technology backbones.

Deep Dive into Value Creation Through Implementation Excellence

Trajectory’s services are explicitly designed to maximize EBITDA and prepare the PortCo for a premium exit or high-value hold period. Our focus is on embedding operational excellence and process improvement directly into the PortCo’s technological DNA.

- Finance Transformation & EBITDA Maximization (ERP Focus): The financial backbone of any PortCo is its ERP system, often NetSuite in the middle market. Our work with accounting and financial advisory partners is centered on making finance function as an EBITDA lever:

- Cost Reduction through Automation: By implementing and optimizing NetSuite, we automate manual, redundant financial processes, from accounts payable to multi-entity consolidation. This drastically reduces the cost of the finance function, directly boosting EBITDA.

- Rapid Closing Cycles: PE firms demand granular, real-time visibility into performance. Our NetSuite implementations are engineered to shorten monthly close cycles, providing operating partners and the board with faster, more reliable data for strategic decision-making.

- Scalable Architecture for M&A: A key part of the PE strategy is often the “buy-and-build” model. Trajectory builds the initial NetSuite or core ERP platform with scalability in mind. This enables easy, low-cost integration of future add-on acquisitions (bolt-ons), significantly enhancing the long-term value of the investment.

- Growth Enablement & Revenue Optimization (CRM Focus): Sales and marketing functions are the top-line drivers of value. Our expertise in Salesforce CRM ensures the strategic partners’ growth thesis is enabled by technology:

- Unified Commercial Processes: Following a series of acquisitions, a PortCo often has disparate sales processes and multiple CRM instances. Trajectory unifies these into a single Salesforce instance, providing a consolidated view of the customer, standardizing sales motions, and allowing for centralized marketing efforts.

- Data-Driven Forecasting: We implement solutions that link sales data, pipeline forecasting, and revenue recognition seamlessly, often integrating Salesforce with NetSuite. This single source of truth eliminates debate over numbers, allowing the strategic partner to focus on optimizing the sales funnel rather than correcting data.

- Digital Transformation Value Creation: Our team helps revitalize underperforming assets by aligning the technology roadmap with the capital strategy. We focus on enhancing margins, optimizing operations, and creating tailored tech stacks that sustain value creation long after the initial implementation is complete.

- Leveraging Integration & AI for Competitive Advantage: The modern PortCo tech stack is an ecosystem. Our core expertise in integration, often using solutions like InitusIO, Boomi, or Mulesoft, is the key that locks in the value created by our partners:

- Systems Integration: We ensure the NetSuite (ERP) and Salesforce (CRM) talk seamlessly, but also integrate the myriad of other systems, HRIS, logistics, proprietary systems, into a unified data flow. This eliminates silos, unifies data, and provides the single source of truth necessary for operational transparency.

- AI Enablement: The newest frontier in PE value creation is Artificial Intelligence. Trajectory offers AI Enablement Services, leveraging tools like InitusGPT and InitusDecoder. We help PortCos and their strategic partners identify high-value AI use cases (e.g., intelligent document processing, advanced data migration) and implement them directly into the core systems, turning data into predictive insights and automated efficiency gains. This is a critical differentiator in today’s technology environment.

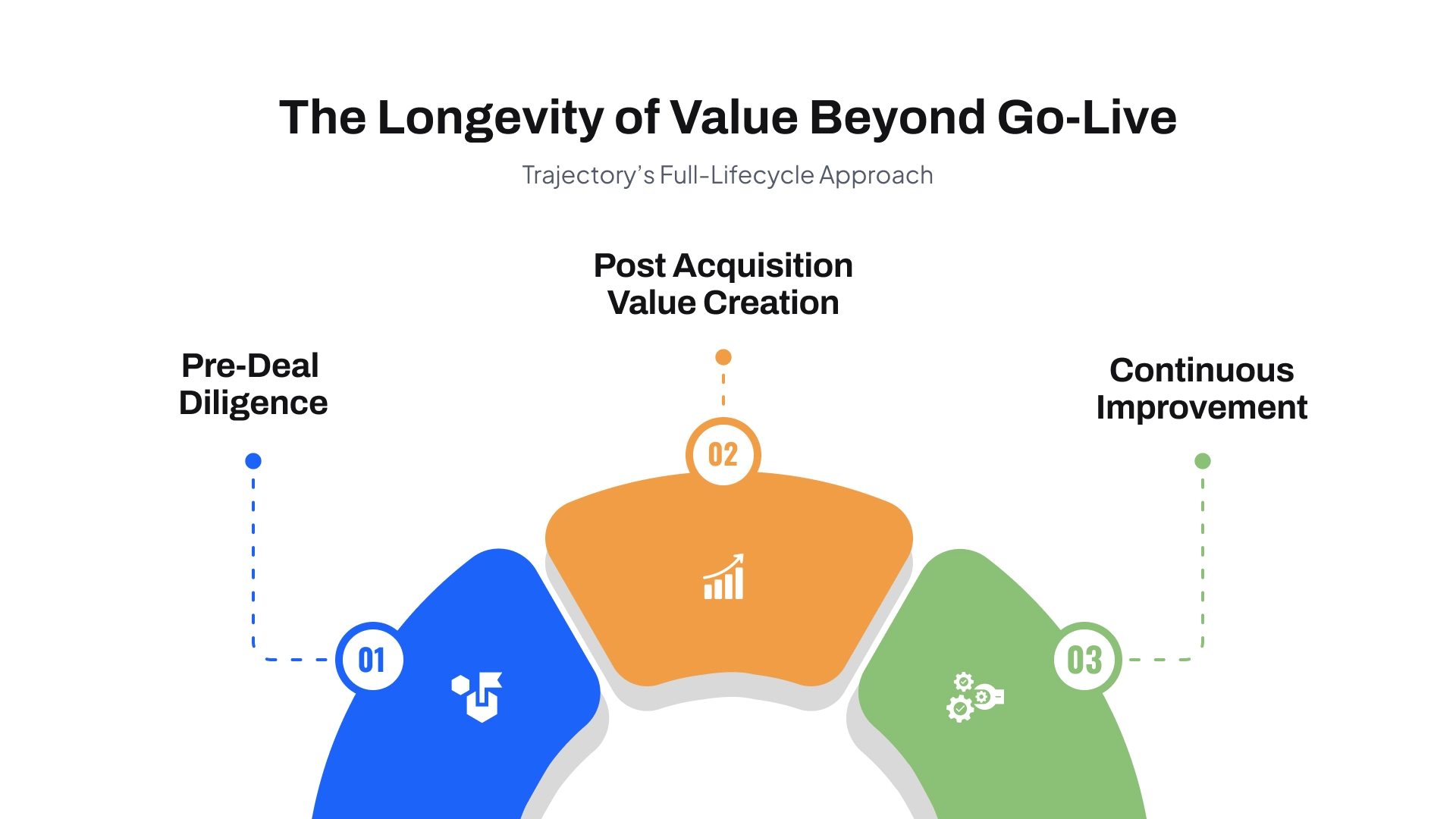

The Longevity of Value Beyond Go-Live

For a PE firm or Family Office, a successful “Go-Live” is just the beginning. True value creation is sustained over the hold period. This is why our partnerships extend beyond the initial implementation phase and into Growth Enablement & Ongoing Operational Improvement.

Scalability is paramount. Every decision Trajectory makes, from system architecture to process design, is filtered through the lens of supporting future add-on acquisitions and long-term organic growth. The scalable tech stack we implement is designed to manage complexity as the PortCo grows and new companies join the platform.

Furthermore, we offer Managed Services. This critical support function allows the PortCo team to avoid the costs and complexities of maintaining an in-house expert team for niche applications like Salesforce or NetSuite administration. By replacing costly in-house support with our expert Managed Services team, the PortCo’s key executives are free to concentrate on the strategic elements of business growth, leaving the complex, ongoing technology maintenance and optimization to Trajectory.

This continuous optimization model ensures that the investment in technology continues to pay dividends long-term. In this model, the strategic partner ensures the business is fundamentally sound; Trajectory ensures the operational machinery is always running at peak performance. This full-lifecycle approach, from pre-deal diligence (alongside strategic partners) to post-acquisition value creation and continuous improvement (via Managed Services), is what makes our partnership model so powerful for PE firms.

The Power of Partnership, Accelerated ROI

In the competitive arena of Private Equity and Family Offices, impactful technological implementation is a strategic weapon. The ability to move faster, consolidate data more effectively, and automate key processes directly correlates with higher multiples at exit and more efficient operations long-term.

The best strategic and accounting advisory firms understand that their reputation and success hinge on their ability to deliver results. By partnering with Trajectory, these firms gain an execution powerhouse, a proven team of specialists who can flawlessly deliver complex, high-stakes CRM and ERP solutions on an aggressive timeline.

Trajectory is the silent engine of PE and Family Office technology acceleration, the implementation nexus where strategic vision meets measurable results. We enable the industry’s top vendors to broaden their service offerings, execute against condensed timelines, and, most importantly, provide the Private Equity and Family Office fund managers, deal professionals, and operating partners with the measurable, technology-driven value that accelerates portfolio performance and maximizes outcomes.